Carmot acquisition propels Roche to forefront of obesity drug leadership, finds GlobalData

In a significant move in December 2023, Roche completed the acquisition of the US-based company Carmot Therapeutics in a deal worth $2.9 billion. This strategic acquisition provides Roche access to Carmot’s portfolio, which notably includes three lead molecules, all GLP-1 analogues, currently in the advanced stages of clinical trials for obesity and type 2 diabetes. This acquisition positions Roche on par with other industry leaders in the realm of GLP-1 analogues, such as Novo Nordisk, Eli Lilly and others, according to GlobalData, a leading data and analytics company.

GlobalData’s Technology Foresights model recognizes GLP-1 analogues as a high-impact innovation, with accelerating patent trends and other markers indicating their near-term impact. Notably, leaders in this space, like Novo Nordisk and Eli Lilly, have experienced significant success, with share prices surging over 20% in 2023 year on year due to the sales of their respective GLP-1 agonist brands, Wegovy and Mounjaro.

The Technology Foresights model also identifies over 70 companies, including early-stage ventures, actively developing innovative products utilizing GLP-1 analogues. The model further suggests that these molecules, primarily targeting obesity and type 2 diabetes, are also being explored for applications in neurological disorders and NASH type Hepatitis.

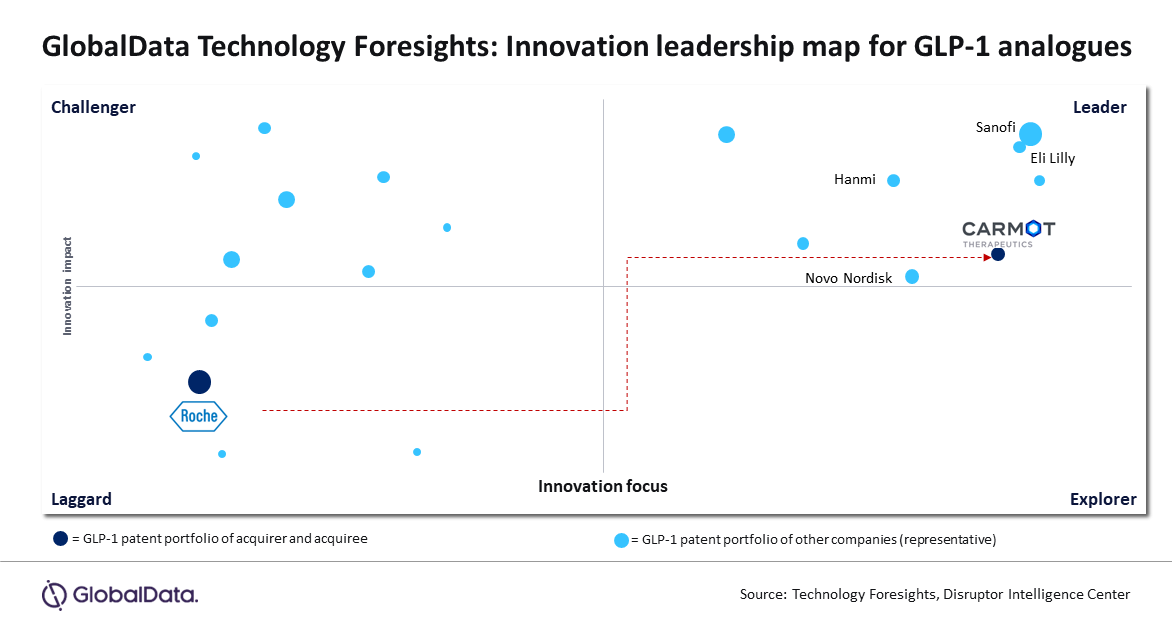

Sourabh Nyalkalkar, Practice Head of Innovation Products at GlobalData comments: “As a major player in the pharmaceutical industry, Roche has traditionally focused its research and development (R&D) efforts on cancer research, diagnostics, and gene therapies, as evidenced by the 120+ innovation areas tracked for Roche on the Technology Foresights model. However, innovations in lifestyle disorders, such as GLP-1 analogues, were not a key focus until this recent acquisition.”

On the other hand, Carmot Therapeutics, a privately held company, centred its innovation portfolio almost entirely on GLP-1 agonists. Two out of its four molecules have received positive responses in Phase I clinical trials, positioning Carmot among the leaders in the field of GLP-1 analogue innovation, as identified by GlobalData’s proprietary framework.

Sourabh concludes: “Roche’s well-timed move aligns with the resounding success of GLP-1 agonists like Ozempic, Wegovy, and Mounjaro. The shift in Roche’s position is evident on the innovation leadership map. This move also signals a potential trend, suggesting that other major pharmaceutical players with a strong market presence may be actively seeking targets with robust innovation portfolios in GLP-1 analogues. The Technology Foresights model emerges as a valuable tool for evaluating potential targets in this evolving landscape.”

2A+ Farma Portal de notícias

2A+ Farma Portal de notícias